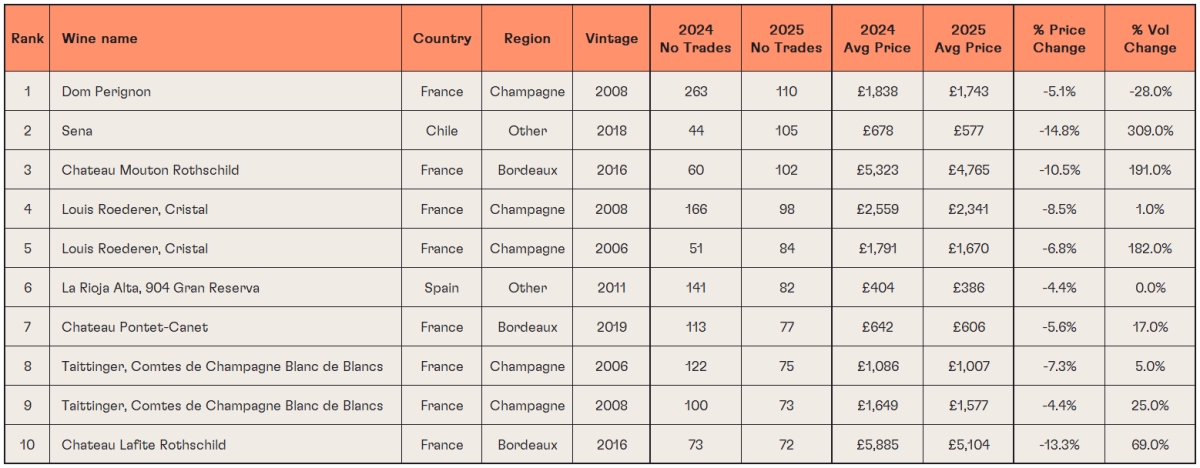

The Top 10 Most Traded Wines of 2025 (So Far)

As we pass the halfway point of 2025, global fine wine trading is showing some fascinating shifts. From Champagne icons to Chilean surprises, here are the 10 wines driving the most action on the secondary market so far this year.

1. Dom Pérignon 2008 (Champagne, France)

Still the king of liquidity. Dom Pérignon’s legendary 2008 vintage topped the charts again, with 110 trades in the first half of the year. That’s down from 263 in 2024 (a -28% dip in volume), but it remains the benchmark Champagne in global trading. Prices softened slightly, falling -5.1% to £1,743 per 12x75, but the sheer consistency of Dom shows its enduring global demand.

2. Seña 2018 (Aconcagua Valley, Chile)

The breakout star of 2025. Chile’s Seña 2018 exploded with 309% more trades versus last year, making it the biggest riser in the top 10. While average prices fell -14.8% to £577, this very drop seems to have fuelled liquidity as buyers rushed in. Seña’s presence this high in the rankings is a sign that top Chilean wines are carving a real place in global portfolios.

3. Château Mouton Rothschild 2016 (Pauillac, Bordeaux)

First Growth pedigree, big market demand. Mouton’s 2016 vintage surged with 191% more trades, cementing its place as one of the most liquid Bordeaux wines of the moment. Prices slipped -10.5% to £4,765, but Mouton’s trading growth shows how Bordeaux’s prestige labels remain reliable secondary-market engines.

4. Louis Roederer Cristal 2008 (Champagne, France)

Cristal 2008 remains one of the hottest Champagnes on the market. Trading volumes held almost flat year-on-year (+1%), but demand remains strong. Prices eased -8.5% to £2,341, showing that Champagne buyers are still value-sensitive but unwilling to ignore an icon.

5. Louis Roederer Cristal 2006 (Champagne, France)

Cristal makes the list twice, underlining its liquidity credentials. The 2006 vintage jumped 182% in trading volumes, making it one of the biggest risers of the year. Prices slipped -6.8% to £1,670, but volume growth suggests many collectors are re-rating Cristal as a tradable Champagne rather than just a luxury drink.

6. La Rioja Alta 904 Gran Reserva 2011 (Rioja, Spain)

Spain’s most consistent blue-chip Rioja continues to hold its ground. Trading volume stayed flat, while prices dipped a modest -4.4% to £386. At this accessible price point, Rioja Alta continues to be a gateway fine wine for investors and drinkers alike.

7. Château Pontet-Canet 2019 (Pauillac, Bordeaux)

The biodynamic disruptor of Bordeaux keeps moving. Volumes rose 17%, even as prices softened -5.6% to £606. Pontet-Canet has carved out a niche as a forward-looking Cru Classé with serious long-term backing, and its 2019 is proving one of the most tradeable modern Bordeaux vintages.

8. Taittinger Comtes de Champagne Blanc de Blancs 2006 (Champagne, France)

Another Champagne classic on the list. Comtes 2006 saw steady volume (+5%) and a slight price dip to £1,007. Its resilience underlines Champagne’s dominance in the liquidity rankings: five of the top ten wines are from the region.

9. Taittinger Comtes de Champagne Blanc de Blancs 2008 (Champagne, France)

The 2008 vintage of Comtes tells a similar story. Volumes rose 25% with a small price slip to £1,577. The fact that both 2006 and 2008 vintages made the list shows how Champagne’s prestige cuvées are now as much portfolio assets as celebratory drinks.

10. Château Lafite Rothschild 2016 (Pauillac, Bordeaux)

No surprise here: Lafite is always near the top. Trades rose 69% in 2025, proving that demand for First Growth Bordeaux remains strong. Prices dipped -13.3% to £5,104, the sharpest decline in the top 10, but this likely reflects broader Bordeaux pricing trends rather than a drop in Lafite’s prestige.

Key Takeaways

- Champagne dominates liquidity – Half of the top 10 are prestige Champagnes, underlining the region’s unrivalled secondary-market appeal.

- Chile makes history – Seña’s 2018 vintage is the breakout story, with the biggest surge in trades of any wine on the list.

- Bordeaux First Growths stay powerful – Both Mouton and Lafite 2016 feature prominently, even amid pricing pressure.

- Prices down, volumes up – Almost every wine saw average prices slip in 2025, but in many cases (Seña, Mouton, Cristal 2006), that drove higher trading activity.

This top 10 list shows how the fine wine market in 2025 is evolving: Champagne remains the heartbeat of liquidity, Bordeaux retains its blue-chip prestige, and new players like Chile are breaking through.

The Half-Year Wine Market Review: What the Data Says & What’s Next?

Explore our full Half-Year Wine Market Review for deeper insights into trading volumes, pricing trends, and regional highlights from 2025 so far. You can also download the complete dataset for a detailed look at the underlying analysis.