Why fine wine can provide an excellent long-term hedge against an uncertain inflation outlook.

Inflation is back! In many major economies, consumer prices are rising at their fastest pace since the global financial crisis a decade ago. For example, US consumer prices (CPI) rose at an annual rate of 6.2% in October, a 31-year high. UK inflation jumped by 4.3% the same month, the highest annual rate in a decade. European countries and China are also seeing consumer prices accelerate on the back of rising energy costs, supply chain disruption from the pandemic, as well as pent-up demand as economies reopen and savings rates remain high.

Economists remain divided as to whether inflation will stay high well into 2022 or ease. However, the situation provides a reminder of the importance of considering the risks from inflation when making your investment choices.

What can fine wine do for your investments?

Long-term real returns

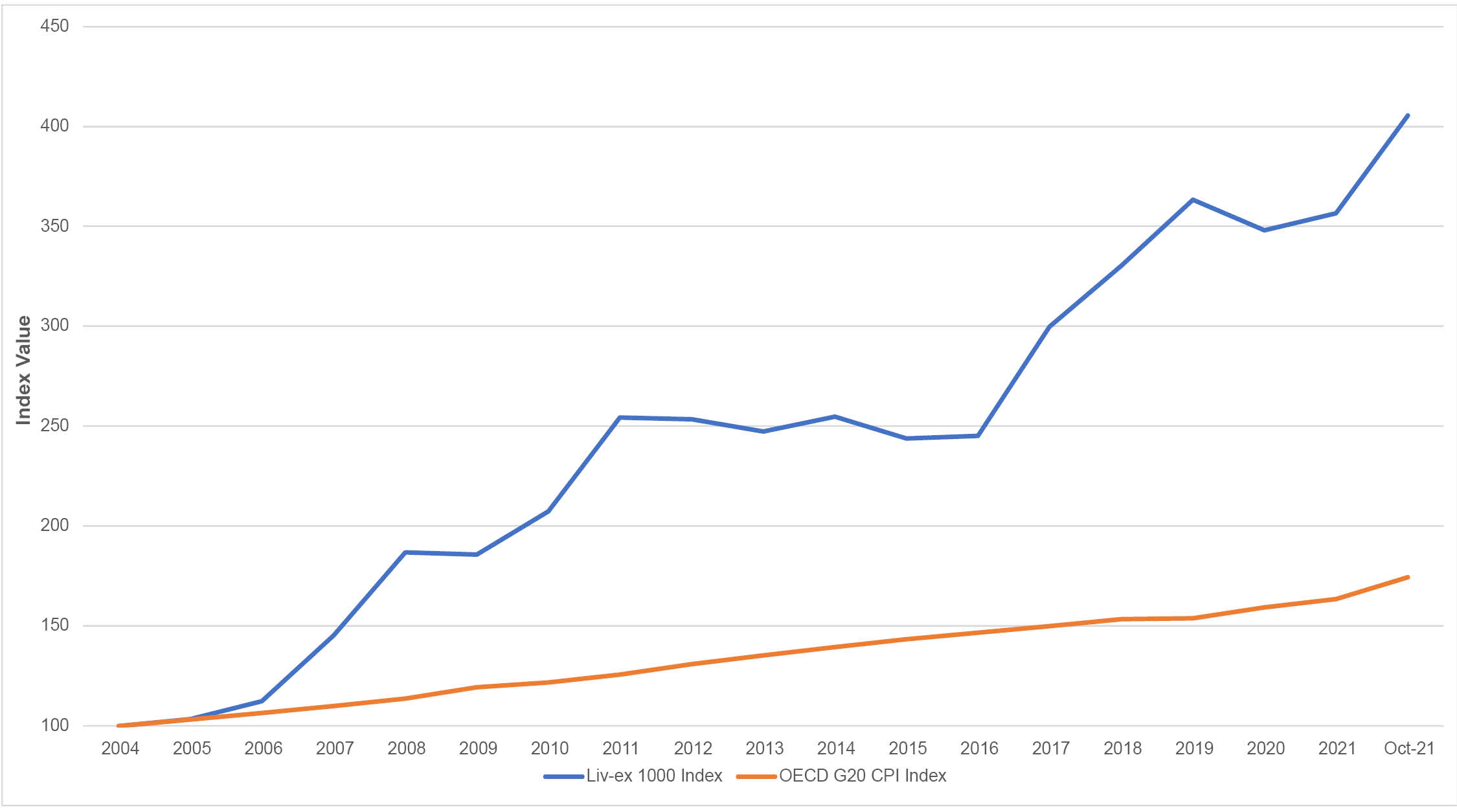

Fine wine boasts a track record of strong growth that has resulted in positive real returns over the long-term. Since its inception in 2004, the Liv-ex 1000 index, the broadest measure of the fine wine market, had returned 315% through the end of November 2021.

Adjusting for inflation over the period using OECD’s G-20 CPI data, the real return still stood at an impressive 125.8%. In 2021 when inflation has spiked, fine wine’s performance has also accelerated with a year-to-date return of 16.5% through the end of November.

Strong and steady real returns

Liv-ex 1000 vs OECD’s CPI index (G-20 economies) since 2003

Source: Liv-ex, OECD.org as of 31 Oct 2021

Fine wine also exhibits a remarkable degree of stability through different market backdrops. For example, when the COVID-19 pandemic hit in early 2020, fine wine’s downturn was both shorter and less severe than most mainstream financial assets. We saw a similar trend back during the financial crisis.

This is important because during periods of high inflation, some investors will chase higher returns with higher risk investments. However, increasing your portfolio risk may not align with your long-term investment priorities. Fine wine can offer a safe, stable choice that can still compensate for rising inflation.

An investment for all seasons

Rather than increasing or decreasing exposure to fine wine depending on the prevailing inflation outlook, we believe fine wine can form a permanent component of a portfolio that can perform through shifts in inflation and other macro conditions.

This is because as an alternative ‘passion’ asset, the primary drivers of fine wine prices are internal factors, including supply/demand, wine quality and brand prestige. Fine wine is, therefore, less susceptible to changes in the inflation or wider economic outlook than other financial assets.

A supply/demand imbalance is the primary driver of fine wine prices. Supply levels are constrained as only specific vineyards in certain regions have the necessary qualities and recognition to produce top quality wines. This scarcity element can help keep price performance consistent and above the rate of inflation in different macro backdrops.