Diversification, risk mitigation, low volatility… the list goes on.

What does a smart investor’s portfolio look like? Traditional schools of thought would say that the long-established 60/40 equity and bond asset allocation model is the right avenue for success, and indeed, it’s served many investors well – there’s a reason it’s cited time and time again, after all.

But in these increasingly turbulent times, many investors are looking to alternative assets to help mitigate risk, hedge against inflation and, crucially, achieve a good return on investment (ROI).

Although ‘alternative assets’ is a relatively modern term, the concept is not a new phenomenon. Some of the earliest examples of private-capital-type investments can be traced back as far as the 1800s, for example, when individuals made investments into projects during the Industrial Revolution.

Today, the term is used to cover a range of investment instruments, from private equity and commodities, to real estate and collectibles such as fine wine.

And they’re growing in popularity. According to Connection Capital, more than two thirds of its HNW clients dedicate upwards of 10% of their portfolios to alternative assets, up from just half in 2018. Meanwhile, a third of investors say they’re planning on increasing their exposure to alternative assets over the next 12 months.

We believe fine wine forms one of the most interesting and lucrative alternative investments available. Here, we examine what fine wine investments can do for your portfolio.

Diversification

Every clued-up investor knows you shouldn’t put all your eggs in one basket and that diversification is crucial. But a well-diversified portfolio is not simply a case of picking a range of stocks, bonds and mutual funds, as these are often vulnerable to the same systemic risk factors. Some collectable alternative assets offer lower correlation to stock and bond investments, so can provide diversification through reduced risk exposure.

Stability during a downturn

The aim of alternatives isn't always to have high short-term returns, but to protect your investments during bear markets, which can help achieve consistent returns over time. As such, alternatives are often able to dampen volatility and provide a degree of downside protection when other markets are not doing so well.

Consider this. During the global financial crisis of 2008-2009, the Liv-ex 1000 – the broadest measure of the fine wine market – dropped roughly 10% from its peak in August 2008 to a low in December. At this point, it began a steady recovery, recouping all its losses by the end of 2009. By contrast, major equity indices plummeted by over 30%. Fine wine’s more consistent recovery from a shallower dip means it posted a higher total return over the full breadth of the crisis period.

A hedge against inflation

The primary drivers of fine wine prices are internal factors, including supply/demand, wine quality and brand prestige. Fine wine is, therefore, less susceptible to changes in the inflation or wider economic outlook than other financial assets. This can help it deliver favourable long-term real returns (returns adjusted for inflation), making it an investment you don’t need to worry about increasing or decreasing exposure to depending on the prevailing inflation outlook.

Return potential alongside low volatility

Fine wine has a long history of strong returns on investment. Since 2005, the Liv-ex 1000 index is up 301.6%, comparable or better than many global equity markets. Fine wine has achieved these impressive returns with remarkably low volatility relative to some other financial markets.

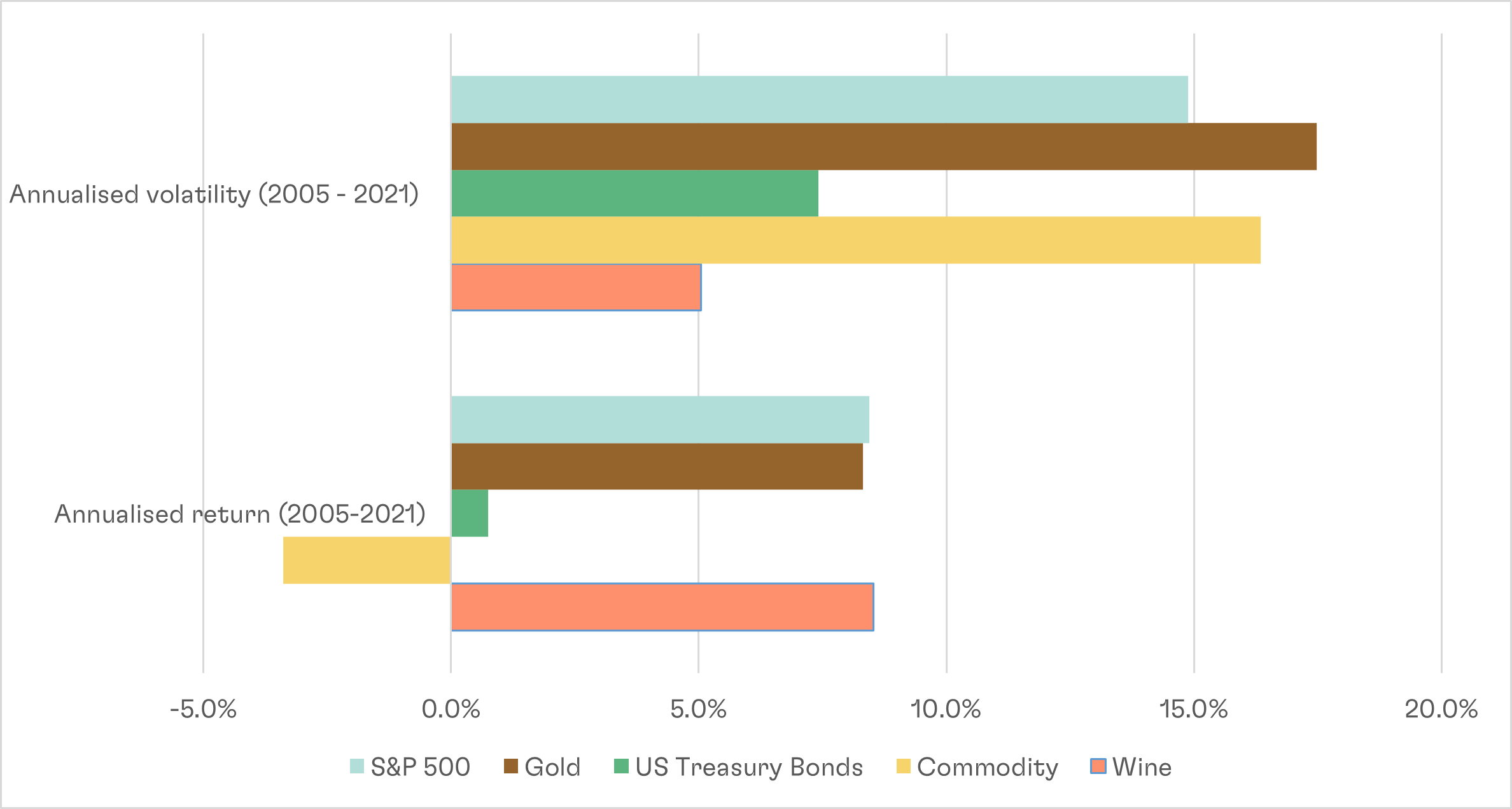

Low volatility plus healthy returns

Comparison of volatility and annualised return across financial assets (Jan 2005 – Nov 2021)

Source: Liv-ex as of 30 November 2021. Past returns are not a guarantee of future performance.

These impressive risk-adjusted returns are a by-product of a supply and demand imbalance, and the fact that fine wine has an inverse supply curve which becomes more pronounced as people drink a particular wine. This stability translates to peace of mind for investors who needn’t worry about ‘timing the market’.

Fine wine also stacks up well against other real-asset investments. Just take a look at the Knight Frank Luxury Investment Index (KFLII), an index that measures various investment-grade assets. In 2020, five of its nine asset classes had a negative return on investment. Fine wine, however, posted 13% for the year, the second-best performance only behind Hermès handbags.

Passion

Alternative investments that fall into the collectibles category are often called ‘passion assets’ because they are a tangible product that spark joy and interest. The pursuit of building a solid collection can bring an additional benefit beyond any ROI. You needn’t be a sommelier-level wine connoisseur to invest in fine wine, of course, but few would deny the charms of expanding your knowledge, and your palate, about this celebrated luxury drink while also improving your portfolio.