A Toast to Opportunity: Navigating the Wine Investment Landscape in 2024

In recent years, the wine investment market has experienced significant fluctuations, influenced by broader economic conditions and monetary policies. Following a 12 to 18-month correction period, during which wine prices fell by approximately 20%, the tide appears to be turning. This article examines the current state of the wine market, explores the impact of shifting economic policies, and discusses the potential for wine investments in the coming years.

If you’d like to read our initial analysis from earlier in the year, click here.

Market Correction and Signs of Stabilisation

The wine market has not been immune to the global economic challenges and the tightening of monetary policies by central banks. The impact of increased interest rates and a generally cautious economic environment contributed to a notable decline in wine prices. However, the leading wine index’s recent performance suggests a stabilisation. The index posted a modest gain in March, marking the first positive movement after a year of negative trends. This shift is a key indicator that the market might be settling into a new equilibrium.

Monetary Policy and Its Implications for Wine Investments

Central banks have signalled a potential easing of interest rates in 2024. This anticipated shift could decrease the allure of traditional cash investments, prompting investors to seek alternative assets, including wine. The relationship between lower interest rates and increased investment in alternatives hinges on the reduced returns of more traditional and less risky assets, making alternatives like wine more attractive.

The Potential Upside for Wine Investments

Equities markets often react quickly to forecast changes in interest rates, sometimes adjusting prices to reflect anticipated future conditions. However, alternative investments like wine typically lag behind these adjustments. This delay presents a unique opportunity for investors to capitalise on potential upsides that have not yet been fully priced into the market.

As borrowing costs decrease, economic activity generally increases, potentially enhancing wealth creation globally. The performance of luxury goods, including wine, tends to correlate with global wealth trends. Thus, a revitalised economy could bolster the wine market, creating medium-term investment opportunities.

Reversing the Decline: Is Now the Time to Invest?

The recent downturn in wine prices, coupled with prospective reductions in interest rates, positions the wine market as an attractive entry point for investors. Historical data shows that wine investments have yielded an average annual return of 8-10%. Given the current market conditions and the outlook for interest rates, investing now could offer substantial returns in the medium term.

Diversification Benefits of Wine Investment

Apart from the potential for attractive returns, wine investments provide diversification benefits, reducing risk in an investment portfolio. Unlike stocks and bonds, the value of wine is derived from a different set of market dynamics, including scarcity, vintage quality, and brand prestige, which are less directly linked to stock market performance or economic downturns.

Conclusion

As we look towards 2024, the wine investment landscape presents a compelling case for consideration. The expected reduction in interest rates, combined with the recent stabilisation of wine prices, suggests that the market may be poised for a return to growth. For investors willing to adopt a medium-term outlook, allocating a portion of their portfolio to wine could enhance potential returns and offer valuable diversification benefits.

In summary, while the path forward is contingent on various macroeconomic factors, the fundamentals of wine investment remain strong. As such, for those seeking to diversify their investment strategy and capitalise on unique market conditions, the current juncture may represent a particularly opportune moment to enter the wine market.

Download the Fine Wine Versus Alternative Assets 2024 Report

Backed by 2024 data, including performance charts and market forecasts, this report equips investors with the knowledge to consider Fine Wine as a serious investment asset, safeguarding capital against future uncertainties.

Market Analysis: Indicators of Recovery in the Wine Investment Landscape

The recent developments in the wine market point towards a stabilisation and budding recovery, especially evident when examining specific high-profile wines. The trends observed in recent trades, particularly of Lafite 2019 and Promontory 2016, provide compelling evidence of this shift.

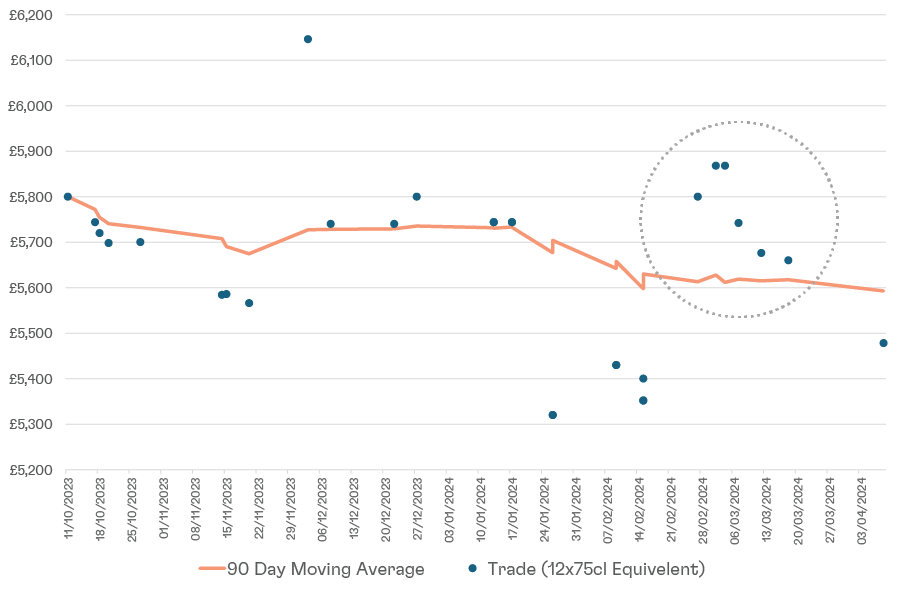

Lafite 2019: A Study in Resilience

Data on recent trades of Lafite 2019 vividly illustrates the initial decline and subsequent recovery. Over the past three quarters, the price of Lafite 2019 consistently declined. However, the last eight weeks have marked a significant turnaround, with trade prices consistently surpassing the 90-day moving average. This pattern not only suggests a recovery but also indicates growing investor confidence, as seen in the volume and consistency of trades above this key benchmark.

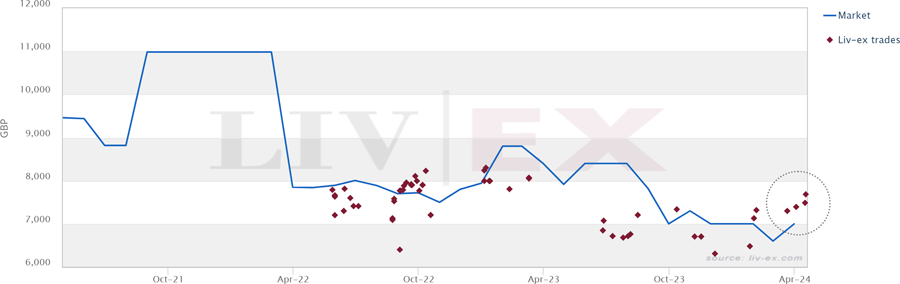

Promontory 2016: Consecutive Gains Indicate Market Bottom

An analysis of Promontory 2016 trades further underscores the market's recovery. After reaching its market bottom, subsequent trades have consistently registered higher, illustrating a robust rebound. This upward trend in a wine like Promontory 2016 not only demonstrates the wine's intrinsic value but also reflects broader market recovery, as investors begin to re-enter at attractive price points.

General Market Trends

Broadly speaking, the wine market has shown a promising trend of stability and recovery. A significant proportion of trades have been executed at prices that meet or exceed the last trade and/or the 90-day moving average. This pattern indicates strong support at current price levels, suggesting that the market may have found its footing after the previous period of volatility.

Conclusion

The trading patterns of high-profile wines such as Lafite 2019 and Promontory 2016 serve as microcosms of the larger wine market's dynamics. These examples provide tangible evidence of a market that is beginning to stabilise and recover, making a compelling case for renewed investor interest. The increase in trades above significant moving averages and the sequential price increases of specific vintages are indicative of a market that is regaining its balance, offering potential for growth to informed investors.

Schedule Your Free Investment Consultation

Book a call to discuss how Fine Wine can diversify your portfolio and protect your capital in volatile markets, and ask any questions you may have.

Latest Articles