The new crop of 2018 California wines could be an ideal entry point into this high-quality fine wine market. As we highlighted in our recent investment report, the regional market is making up for a slow 2020 with a red hot 2021. The Liv-ex’s California 50 index is up 10.5% year-to-date return through the end of August. From this perspective, the new releases are coming at the right time.

However, the California market still calls for a disciplined approach as it remains dominated by a handful of ‘cult’ producers that command very high prices. Although periods of rapid growth can sometimes lead to a temporary lull in price performance as buyers seek value elsewhere, we think several of the 2018 releases appear poised for long-term growth. The 2018 vintage is deemed by many as one of the best in recent years, featuring ideal weather conditions throughout the growing season in most places.

A major factor that California producers have struggled with in recent years is wildfires, which have reduced quantity or impacted quality in some places. Although there were fires in the state in 2018, most reviews indicate the top producers emerged largely unscathed with an excellent vintage. So far this year, California wines have received more 100-point scores from critics (according to Liv-ex) than any other wine region.

However, wildfires were widespread in 2020 and 2021, and it remains to be seen what the impact will be on these upcoming vintages. Concerns of smoke taint could dent yields or even lead to some producers to not make a vintage in a certain year. Lower volumes in the coming years could add upward pressure on prices for existing wines, including the new 2018 releases. Many of California’s top names are difficult to get hold of at the best of times and this would add to the competition. Here, we look at a few of the most attractive new releases from the in-demand 2018 vintage.

Vérité La Muse and Dalla Valle Maya – 100-point stars

Two of the finest examples of the stellar 2018 vintage are Vérité’s La Muse and Dalla Valle Maya, both receiving 100-point scores from Wine Advocate.

La Muse is a 90% Merlot, 6% Cabernet Franc, and 4% Malbec blend that rivals the some of the very best from Bordeaux. This is unsurprising as the father-daughter winemaking team of Pierre and Hélène Seillan have extensive experience in Bordeaux and elsewhere in France with these varieties, helping them deliver this 2018 standout.

Winemaker and estate director Maya Dalla Valle also achieved perfection with her eponymous wine from this in-demand Napa winery. Both of these wines will command high prices, but these new benchmark scores will help secure long-term demand and secure their investment potential.

Joseph Phelps Insignia

Joseph Phelps’ flagship wine is one of most sought-after Napa ‘cult’ wines and consistently pulls in scores in the upper 90s. Using an estate-based model allows for the best grapes to be sourced each year from across Joseph Phelps’ vineyards to maximise the quality in each vintage. Although always a Cabernet Sauvignon-led blend, Insignia’s exact makeup will vary slightly each year with the 2018 incorporating small amounts of Petit Verdot, Malbec, and Cabernet Franc.

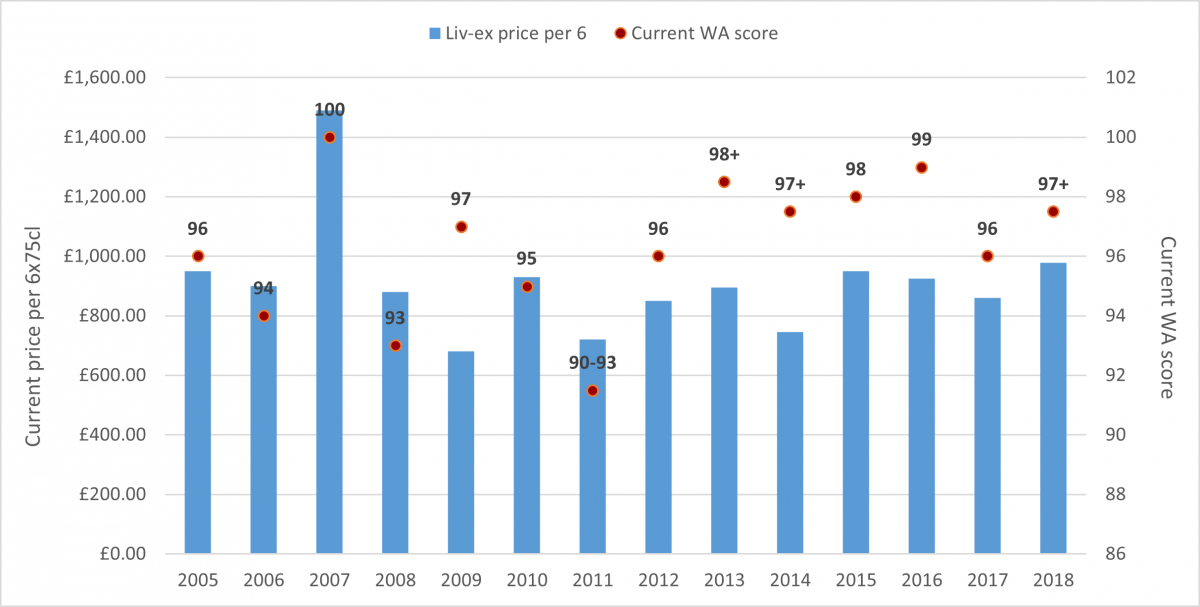

Insignia wines tend to deliver long-term price performance, especially after the five-year mark, meaning this is a relatively safe long-term investment, in our view. The £978 (6x75cl) UK RRP comes broadly in line with market prices for back vintages from the past decade with similar score ranges. With the outlook less certain for future vintages due to possible fire and smoke damage in Napa, this 2018 as well as some good-value back vintages (2013, 2014, 2016) of Insignia offer excellent buying opportunities.

Joseph Phelps Insignia Relative Value Analysis

Source: Liv-ex as of 13 September 2021

Opus One

An icon of the California wine scene, Opus One’s history starts in 1978 as a joint venture between Baron Philippe de Rothschild and celebrated winemaker Robert Mondavi. Its success over the years has generated a dedicated global following with the important Asian market a key driver of demand. Opus One wines are also typically more approachable than some overpowering California counterparts, meaning bottles start getting consumed earlier. The combination of a global audience and scarcity fuels Opus One’s consistent price growth over time.

The new 2018 release is one of the top scoring Opus Ones ever. And with a current market price in line with recent back vintages irrespective of score, there clearly is exciting growth potential for this excellent wine.

Opus One Relative Value Analysis

Source: Liv-ex as of 13 September 2021